Basic Views on Corporate Governance

Our Group aims at achieving sustainable growth and maximizing the enterprise value for medium- and long-term under the management philosophy with obtaining credibility from all stakeholders surrounding us including shareholders.

We strive to strengthen corporate governance with the basic policy of following five items.

- The Company respects the rights of shareholders and ensures equality, as well as strives to improve the environment for executing rights appropriately and protect rights.

- The Company strives to sincerely cooperate with good sense with stakeholders excluding our shareholders.

- The Company strives to ensure the transparency by appropriately making disclosure according to laws and regulations and voluntarily providing information excluding the disclosure.

- Board of Directors strives to execute its roles and duties appropriately for transparent/fair and flexible decision-making.

- The Company strives to positively communicate with shareholders after sharing the direction of its stable growth for long-term.

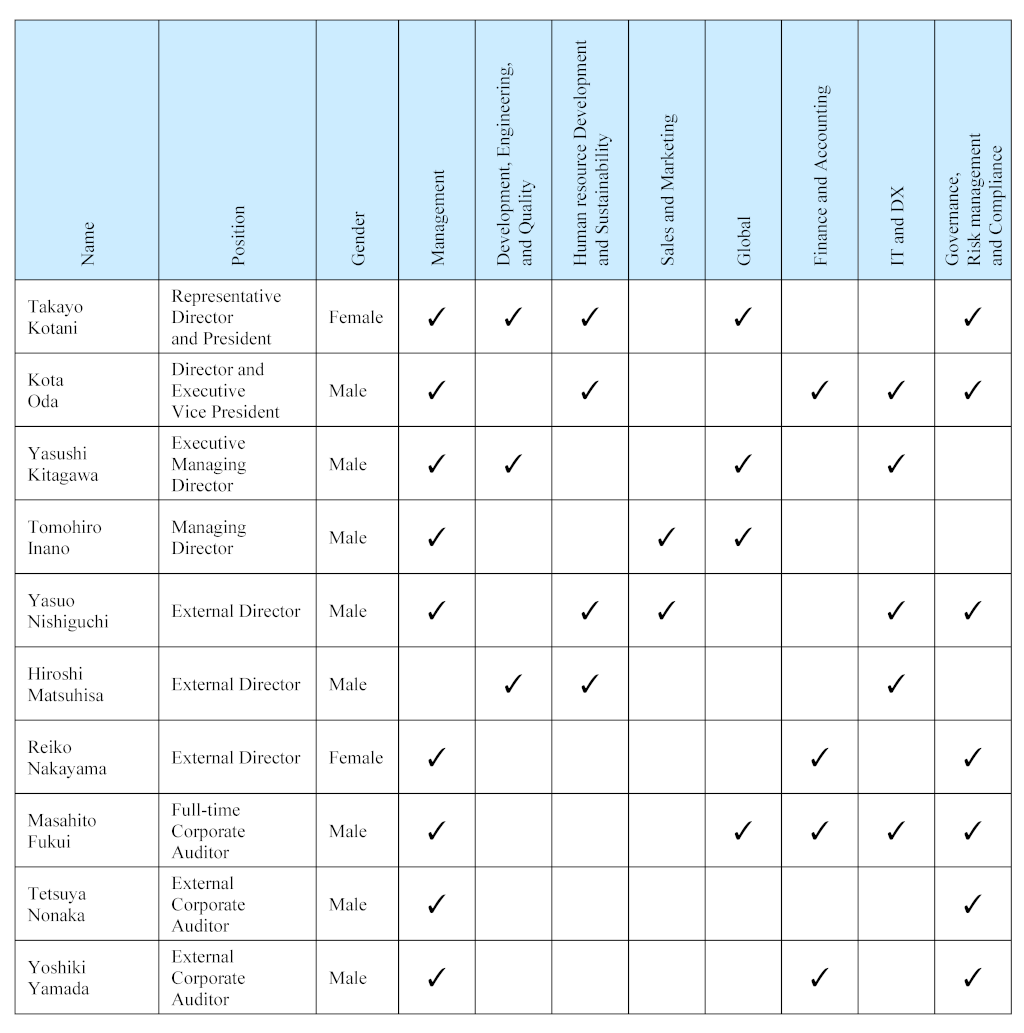

Skills Matrix

In light of our management environment and business characteristics, and in order to achieve sustainable growth in the future, we have identified the skills (knowledge, experience, and ability) that our Board of Directors should possess in order to properly perform its decision-making and management oversight functions. We will continue to review the content of the experience and skills required for our Board of Directors through dialogue with stakeholders.

Our Board of Directors is composed of members who ensure diversity in knowledge, experience, and skills. In order for the Board of Directors to make prompt and appropriate decisions and to realize a highly effective supervisory function, each Director and each Corporate Auditor will appropriately fulfill their roles and responsibilities.

This table shows the four primary skills of each personnel excluding “Management.”

This table does not show all knowledge or experience of each director and auditor.

Ensuring Effectiveness of the Board of Directors and Board of Corporate Auditors

Under rapidly changing business environment and advancement of globalization, the Company appoints candidates of Directors with a focus on balance among knowledge, experience and expertise, diversity and global viewpoints. There are 7 Directors in the Board including External Directors at the moment. The Company will keep the Board in appropriate number to enable them to make quick-decision with each of them providing their expertise and exchanging ideas.

External Directors and External Corporate Auditors who also serves for other companies are annually disclosed at “the Notice of Convocation for the General Meeting of Shareholders,” “Securities Report” and “Corporate Governance Report.”

In addition, in order to further improve the functions of the Board of Directors, an internal questionnaire was conducted to analyze and evaluate the effectiveness of the Board of Directors as a whole, the results of which were analyzed and evaluated, and improvements are being made. The questionnaire conducted in January 2024 identified areas for improvement in terms of agenda setting, and improvements are being made on an ongoing basis.

*All external directors are independent directors.

*All external corporate auditors are independent auditors.

The Board Members’ Compensation System

Our board members’ compensation system is aimed at improving motivation for improving performance and securing and retaining excellent human resources, for the sustainable growth and enhancement of competitiveness of YUSHIN. YUSHIN has decided a new policy for the board members’ compensation at the board meeting held on March 7th, 2022. Nomination and Remuneration Committee accepted the consultations and approved the decision.

- The outline -

• Setting compensation standard in reference to industry standards.

• Strengthening efforts to improve mid-term performance and to drive up the stock price

• Improving objectivity and fairness in compensation deciding process.

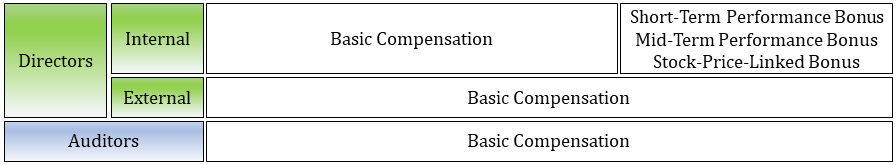

The board members’ compensation consists of monthly compensation (basic compensation,) short-term performance bonuses, and mid-term performance bonuses and stock-price-linked bonuses.

Monthly compensation (basic compensation) is determined by the Representative Director and President, who is delegated by the Board of Directors, based on the evaluation of Directors determined through deliberation by the Nomination and Remuneration Committee within the monthly remuneration range (upper and lower limits) for each position. Short-term performance bonuses are determined by multiplying the base salary of the position by a performance coefficient based on the achievement of the consolidated Ordinary profit, and by reflecting the overall contribution of the Directors based on target management and qualitative assessment. The mid-term performance bonuses and stock-price-linked bonuses are decided by reflecting two coefficients - mid-term performance coefficient based on the growing rate of earning per share (EPS,) and stock-price-linked coefficient based on the growing rate of the stock price.

The makeup of the compensation is determined by position with reference to the external standards of the companies in the same industry and of the same size as the Company (the total of short-term performance bonus and medium-term performance/stock-price-linked bonus is approximately 30%.)

The compensation for External Directors and Auditors consists of fixed compensation (basic compensation.) It is our policy not to pay performance-linked compensations in order to maintain independence in the conduct of business.

- 拡大

- Board Members’ Compensation System in YUSHIN